The Canadian Tire Triangle Mastercard has many perks that make it a desirable wallet addition. One perk is earning Canadian Tire Money on all card transactions, which may be utilized for future purchases. Cardholders receive exclusive discounts and deals at Canadian Tire and allied businesses on a variety of products.

Triangle Mastercard rewards redemption flexibility is another benefit. Cardholders can redeem their points at participating stores or on their credit card balance, giving them more control over their spending. This flexibility makes customized reward schemes more convenient and valuable for users.

Want to know why the Canadian Tire Triangle Mastercard is cool? It gives you Canadian tire money when you buy stuff and lets you go to special events. Plus, it doesn’t have any yearly fees and can save you money on gas at Gas+ spots. This card is all about getting rewards and saving cash while you shop.

Checkout From Amazon

Overview of Rewards Program

Partner Locations

The Canadian Tire Triangle Mastercard offers a points program that allows you to earn rewards at various partner locations. These include well-known stores like Canadian Tire, Sport Check, Mark’s, and more. By shopping at these partners, you can accumulate points quickly.

Exclusive Benefits

When you use the Triangle Mastercard, you can join the Triangle Rewards Program. One cool feature is that American Bankers Insurance Company of Florida’s Purchase Security will cover any damage or theft to your property.

Activation Process

Cardholders can activate benefits like Canadian Tire Services Limited’s roadside assistance as part of the full program rules. This service provides peace of mind when you’re on the road by offering help with services like towing, tire changes, fuel delivery, and more.

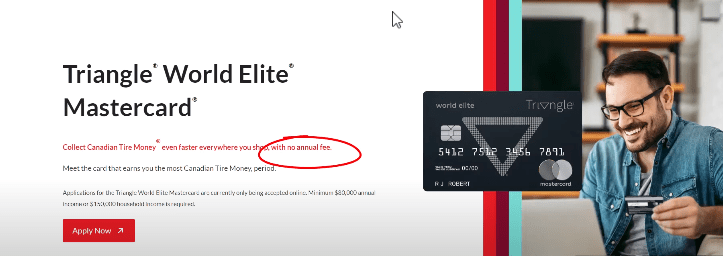

No Annual Fee Advantage

Financing Options

The Canadian Tire Triangle Mastercard is cool because it doesn’t have any yearly fees. This means you can get rewards without paying extra money every year. Also, if you buy stuff over $150 at certain stores, you can pay in equal parts over 24 months without any interest.

Cash Advance Fees and Charges

When you use the Triangle Mastercard, you might have to pay extra fees for cash advances, convenience checks, and dishonored payments. These charges are important to know so you can make smart choices when using your card.

Redemption Options Explored

Fuel and Car Rental Discounts

The Canadian Tire Triangle Mastercard lets you buy fun stuff with CT Money. Some stations offer point-based gas discounts. Linking your Triangle Rewards and Petros-Points accounts earns points for cheaper fuel. CT money can be used to rent cars for parties or trips. It’s a wonderful offer for cheap rentals and shopping rewards.

Bonus Points Accumulation

Smart account linking maximizes Canadian Tire Triangle Mastercard benefits. Triangle Rewards and Petrol-Points accounts can be linked to earn extra points on Petrol-Canada and Gas+ purchases. Loyalty programs work together to accelerate rewards accumulation and boost credit card value.

Annual Collection Limits

If you have a Canadian Tire Triangle Mastercard, remember that there are limits to how many rewards you can get. You can only collect up to 1,000,000 Petros Points or $1,000 CT Money in a year. Knowing this will help you spend wisely and get the most out of your rewards without going over these limits.

Maximizing Rewards Potential

Grocery Store Purchases

Easily maximize your rewards potential with the Canadian Tire Triangle Mastercard by earning up to 3% on grocery store purchases within the first $12,000 annually. This fantastic benefit allows you to earn more while shopping for your daily essentials.

Car Rental Savings

Unlock significant savings with this card by enjoying up to 30% off Avis base rates and up to 35% off Budget base rates for qualifying car rentals. These exclusive discounts provide a great opportunity to save money on your travel expenses.

Double CT Money on Rentals

When renting a car from Avis or Budget, you can double your CT Money earnings. This means that not only do you get great discounts on car rentals, but you also earn double the rewards points, making it a win-win situation for every trip you take.

Efficient point-earning strategies

Fuel Purchases

To earn CT Money on fuel purchases, simply present your Triangle card at participating gas bars when paying with cash or debit. This straightforward process allows you to accumulate points effortlessly.

Merchant Exclusions

Understanding merchant exclusions is crucial for optimizing point earnings. Merchants like Walmart, Walmart Superstore, and Costco are excluded from earning opportunities. By being aware of these limitations, you can focus on transactions that yield rewards.

Transaction Limits

Some stores might have a rule that says you can only spend a certain amount of money in one go with your Triangle Mastercard. It’s good to know this limit so you can buy things smartly and get lots of points.al.

Checkout From Amazon

Comparison with Other Credit Cards

Rewards Programs

Triangle Mastercard offers better rewards programs than other credit cards, letting you earn points on groceries, gas, and more. Flexibility to redeem points for discounts at participating retailers distinguishes its rewards system.

However, some credit cards have limited reward categories or lower earn rates, making them less tempting to diversifiers. To maximize rewards, you must understand each card’s program.

Annual Fees

With no annual charge, the Triangle Mastercard is a good solution for people who want to save money. However, some credit cards have high annual fees that can negate their rewards schemes.

Triangle Mastercard cardholders can maximize rewards earnings without worrying about yearly fees eating into their money because there is no annual charge.

Insurance Coverages

The Triangle Mastercard is cool because it gives you insurance for stuff you buy and when you rent a car. Other credit cards may have similar insurance, but the rules can be different. It’s important to check the details so you know what’s covered.

Reward Structures

Some credit cards give cash back instead of points, while others give travel perks like airline miles. Different rewards work best for different people based on how they spend money and what they like to do.

Unique Advantages of Triangle Mastercard

Concierge Services

The Triangle World Elite Mastercard comes with Assurant Services Canada Inc.’s amazing concierge services. The welcome kit includes everything for booking and discovering local services. Planning travel and finding interesting stuff is easier and more convenient.

Exclusive Savings Opportunities

If you have a Triangle Mastercard, you can get cool deals with Avis and Budget car rentals. This means you can save money and get special offers when you rent cars from these companies. It makes your travel better and saves you cash, especially if you rent cars a lot.

Merchant Transaction Limits

Triangle Rewards members should realize that some stores put a limit on Triangle Mastercard purchases. Keep in mind that shop limits vary, so verify before buying.

Shop smoothly and prevent payment issues using this. Knowing these limits helps you plan your purchases and avoid card issues.

Checkout From Amazon

Tips for Optimizing Rewards

Grocery Store Benefits

Maximize your rewards by taking advantage of bonus offers at grocery stores. Earn extra bonus CT Money on your purchases within the initial $12,000 spent annually. Focus on shopping with select brands to boost your rewards significantly.

Roadside Assistance Activation

By activating services like Canadian Tire Services Limited’s roadside assistance, you can unlock additional benefits. This feature adds value to your Triangle Mastercard, ensuring you’re covered during unexpected emergencies while on the road.

Account Linking Strategy

Enhance your overall rewards accumulation strategy by linking your accounts between Triangle Rewards and Petros-Points. This synergy allows you to earn rewards seamlessly across both programs, maximizing the benefits you receive from each transaction.

Triangle Mastercard Review Insights

Benefits Overview

The Triangle Mastercard is a great card to have. You can earn Canadian tire money when you buy stuff. This means you get points that you can use later on. Plus, there’s no yearly fee! You can also get special deals that only Triangle Mastercard users can get.

Convenience and Flexibility

The Triangle Credit Card is cool because you can earn and use rewards at lots of different places, not just at Canadian Tire. This makes it easy to get the most out of your rewards. Plus, you can also get special payment plans for big purchases or emergencies.

Enhanced Shopping Experience

With the Triangle Card, you get cool deals that match what you like to buy. It also keeps your money safe by protecting you from bad transactions. So you can shop happily without any worries.

Closing Thoughts

You learned cool Canadian Tire Triangle Mastercard facts! It offers benefits without annual fees. Use your points in different ways, earn the most rewards, and compare them to other cards. Remember to earn points wisely and use the card’s benefits to gain the best rewards. You may save money and enjoy interesting incentives with the Triangle Mastercard. Maximize your rewards now!

Frequently Asked Questions

What makes the Canadian Tire Triangle Mastercard rewards program unique?

The Canadian Tire Triangle Mastercard lets you earn CT Money at different stores and gas stations. It doesn’t have an annual fee and helps you get points quickly. It’s different from other credit cards.

How can I maximize my rewards potential with the Triangle Mastercard?

You can get more rewards by using the card for stuff you buy every day, joining bonus point events, and teaming up with others to earn extra points. Learn how to use your points wisely and earn them smartly to get the most out of your rewards.

Is there a comparison available between the Triangle Mastercard and other credit cards?

The blog talks about the Triangle Mastercard and other credit cards. It shows how the Triangle Mastercard is special because it doesn’t have a yearly fee and has cool ways to use your rewards.

Are there any specific tips for optimizing rewards when using the Triangle Mastercard?

The blog post tells you how to get the most out of your rewards. You should plan your purchases smartly, look for bonus points, know how to use your points with Canadian Tire partners, and keep up with special deals just for cardholders.

What are some key insights from the review of the Canadian Tire Triangle Mastercard?

The review talks about cool stuff like no yearly fee, how to get points fast by spending smart, and compares it to other cards. It also shows why this card is great for people who want lots of rewards.